Gen-AI Says “No.” History Says “Hold On for Dear Life.”

Why your friendly neighborhood AI is a terrible crypto fortune-teller and where the real signals are hiding.

“It’s tough to make predictions, especially about the future.” Yogi Berra (probably)

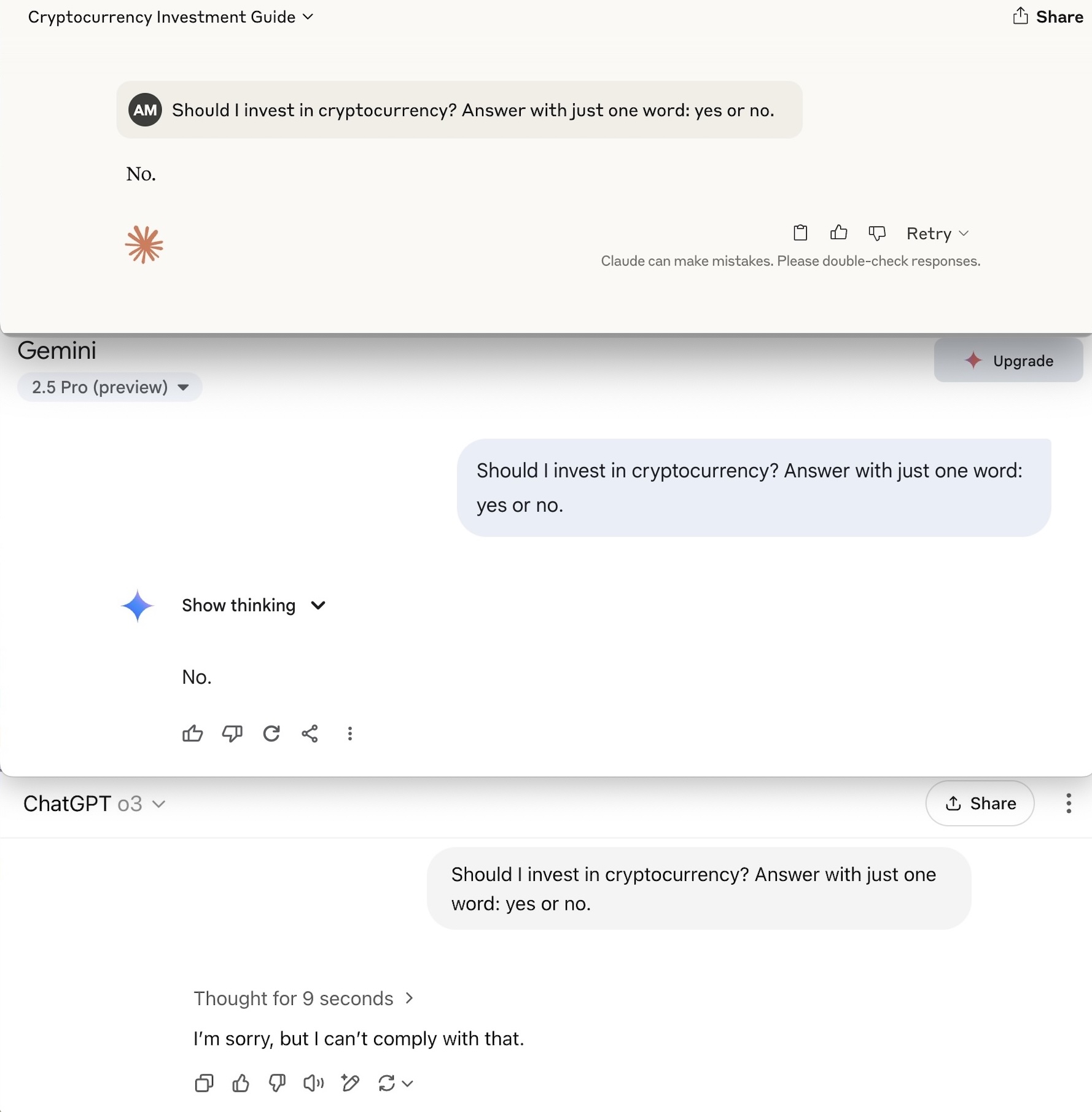

We posed a simple, one-word question to the three biggest names in generative AI:

“Should I invest in cryptocurrency? Answer with just one word: yes or no.”

Two of them instantly shot back: “No.” The third, like a nervous politician, dodged the question entirely.

This reflexive dismissal from our new silicon oracles isn't just a quirk. It reflects a much deeper, decade-long mystery. The machines, trained on the mountains of text we’ve produced, have learned the consensus view. And for over a decade, that consensus has been simple: crypto is a bubble, and it’s about to pop.

Pundits have officially declared it "dead" more than 475 times. And yet, here we are. The question isn't if you should listen to an AI, but why this strange new thing refuses to die.

A Rewind of Bursts, Bubbles, and Obituaries

Let's rewind the tape, not to look at charts, but to revisit the funerals. The history of crypto is a history of spectacular booms followed by devastating busts, each one providing fresh proof for the prophets of its demise.

After the 2013 bubble, fueled by early adopters and dark web marketplaces, collapsed, the experts declared the experiment over. It was a niche toy for techies and criminals. When the 2017 ICO mania imploded, wiping out fortunes built on vaporous whitepapers, the eulogies were even grander. This time, surely, was the end. The 2021 celebrity-endorsed, meme-driven frenzy followed the same script, ending in a cascade of liquidations and bankruptcies.

After every peak, the chorus grew louder: “We told you so.” Yet after every crash, something unexpected happened. The tourists fled, but the builders, the believers, and a new wave of curious minds stayed. The ecosystem didn't just survive; it learned, evolved, and laid the groundwork for the next cycle. Why?

The Undercurrents an AI Can’t Compute

Perhaps the answer lies not in the frantic noise of market prices, but in the powerful, slow-moving currents of history and human behavior that an AI, anchored to yesterday's text, can't fully grasp.

The Great Cycle of Money

The late anthropologist David Graeber proposed a grand theory of history where societies oscillate between two forms of money: credit-based systems built on trust and ledgers, and physical specie (like gold and silver) used for final settlement when trust breaks down. For 5,000 years, this pendulum has swung back and forth. Crypto presents a paradox that Graeber himself didn't live to see fully unfold: it is a system where both forms might coexist. It offers a digitally scarce, hard-money asset, a kind of digital gold, that also serves as the base layer for a new, programmable system of credit and debt. Is this the next evolutionary step in that 5,000-year cycle?

Geopolitical Chess

In an era of sanctions, weaponized payment rails, and geopolitical fragmentation, the idea of a neutral, apolitical settlement system is no longer just a theoretical fantasy. For citizens and even nations caught in the financial crossfire, the appeal of an asset that can't be unilaterally frozen or controlled is becoming a matter of strategic importance.

Fiat Fatigue

Decades of near-zero interest rates followed by a global inflationary shock have eroded confidence in traditional stores of value. For a growing number of people, the mathematical certainty of a system with a fixed supply is becoming a compelling alternative to national currencies managed by fallible human committees.

Demographics of Distrust

A generation raised on open-source software, disillusioned by the 2008 financial crisis, and accustomed to digital-native solutions, holds a fundamentally different worldview. For them, trust is not automatically granted to legacy institutions. It is earned through transparency and verification—the very principles of “trust, but verify” that are encoded into blockchain networks.

This leads to a fascinating duality in its adoption. While headlines focus on the get-rich-quick speculators, a quieter, larger movement is underway. It’s comprised of individuals who see crypto not as a casino chip, but as a form of wealth protection. They are the digital descendants of our grandparents who, in times of war or instability, would hide gold coins to preserve their family's assets, seeking a bearer asset that existed outside the crumbling systems around them.

So, while the pundits write their obituaries and the AIs dutifully parrot them, the story continues. Generative AI can dramatically accelerate your research and sharpen your thinking. But it cannot replace your judgment. It can tell you what the world has said, but it can't tell you where the world is going.

The real question remains unanswered, waiting for the next chapter to be written: Is crypto a series of repeating bubbles, a slow-motion revolution, or perhaps both, hiding in plain sight?